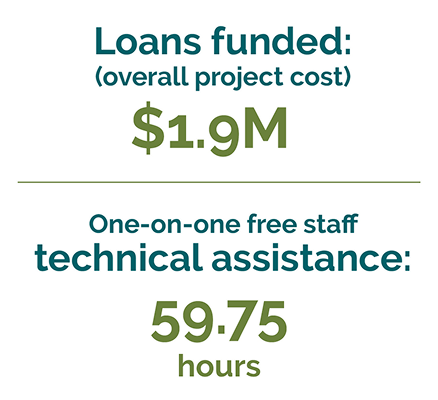

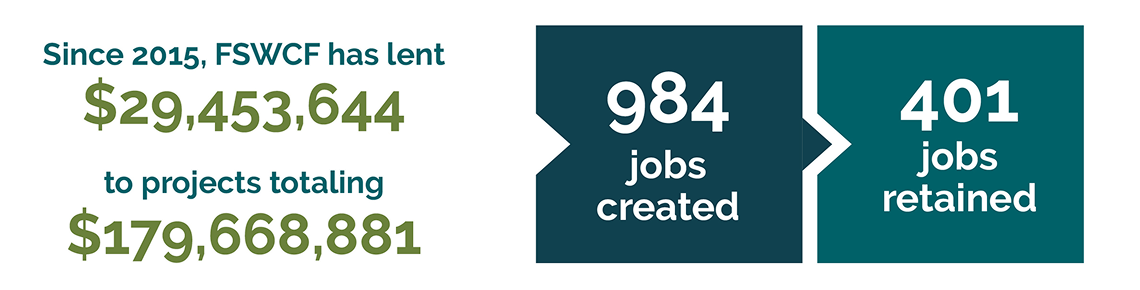

In 2024 we closed our first two deals using funds from the $10 million Affordable Housing Investment Funds (AHIF) grant awarded to us in September 2023. This revolving grant has a reduced interest rate, enabling us to offer a lower rate to support affordable housing projects and increasing housing accessibility.

The first project, Loma Vista Apartments in Walsenburg, CO, will provide 17 multi-family units for local workforce housing. Of these, 8 units will be rented to individuals and families earning under 80% of the Area Median Income (AMI), while the remaining 9 units will be available to those at 120% AMI or below.

The second project, Rock Creek in the Town of Ignacio, CO, includes 45 units comprising a mix of townhouses and apartments. This development aims to address the need for workforce housing, serving the community and surrounding area. These projects exemplify our commitment to expanding affordable housing opportunities through innovative financing solutions.

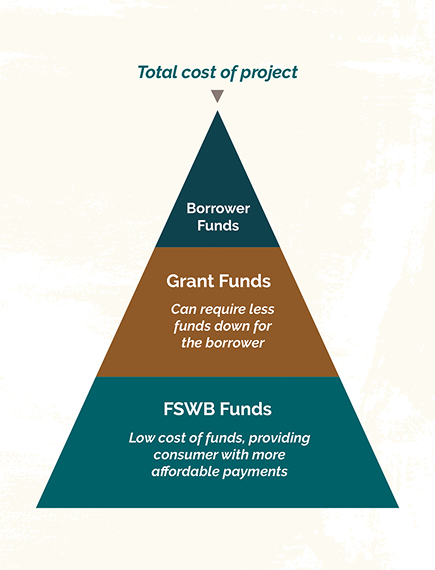

Our unique approach combines grant funds with bank loans, allowing us to offer more affordable financing. By securing low-cost grant funding, we pass those savings on to consumers, creating loan packages with lower payments than traditional options. This makes financing more accessible for individuals and businesses.

These specialized lending solutions enable us to bridge the gap between overlooked communities and the financial resources they need to thrive.